Wrapping Up the Year with Intention

As the year winds down, it’s time to shift from reaction mode to review mode. Every operator, business owner, and HR leader knows how quickly December turns into January with reporting deadlines, tax filings, and compliance updates all arriving at once.

A few proactive checks now can uncover savings, prevent costly compliance errors, and help you start 2026 with confidence. The goal isn’t to add work; it’s to make sure your systems and data are working for you, not against you.

Review Employee and Payroll Information

Your final payrolls of the year are more than just numbers—they’re the foundation for accurate W-2s, ACA forms, and year-end reporting.

Take a moment to confirm that all employee information is correct, including addresses, Social Security numbers, and delivery preferences for tax forms.

Before final payrolls run, audit PTO balances, bonus payouts, and benefits deductions to ensure accuracy and avoid adjustments later.

Integrated payroll and HR systems can make this review seamless, pulling employee data, time-off balances, and deductions into one place for faster validation. Alliance HCM offers seamless connections with tools like Employee Navigator and NCR Back Office, helping payroll, benefits, and time data stay aligned without extra work. See our Tech Stack Efficiency Guide to help you see how well your systems are working together.

Work Opportunity Tax Credits (WOTC): The Overlooked Year-End Opportunity

The Work Opportunity Tax Credit (WOTC) is one of the most underutilized programs across industries. It rewards employers who hire individuals from specific target groups, such as veterans, long-term unemployed individuals, or SNAP recipients, with federal tax credits.

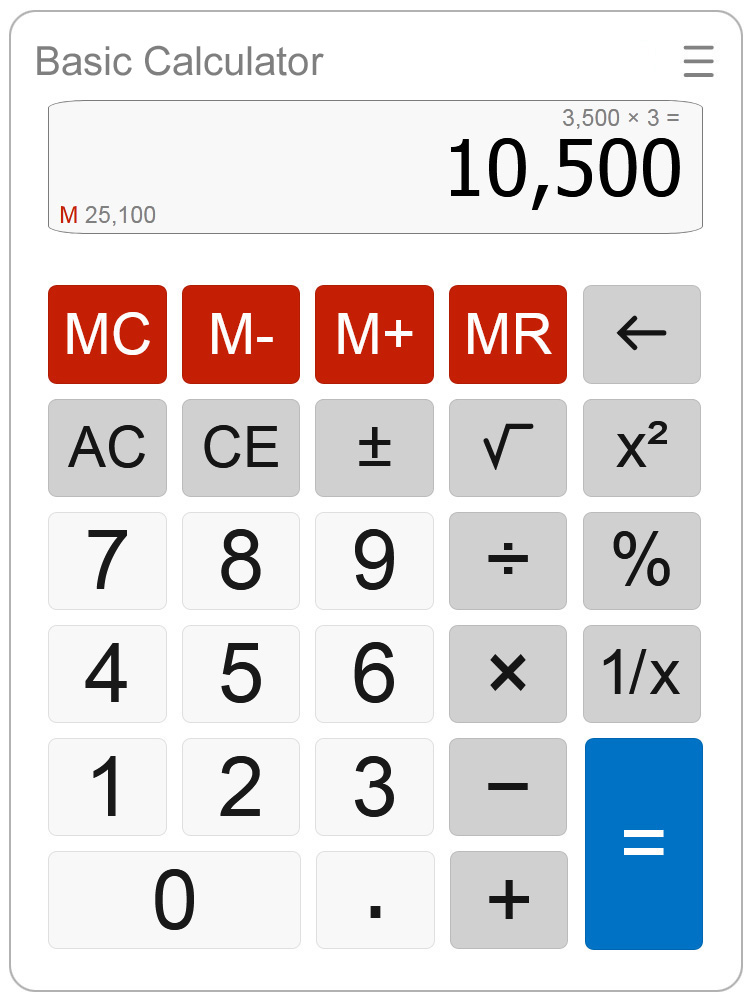

Before year-end, run your WOTC calculator to estimate potential savings and ensure timely certification submissions. Even one qualified hire can translate to hundreds, or even thousands, of dollars in tax credits.

If your HR and payroll systems are integrated, the process becomes even simpler. Automated screening and submission tools ensure you don’t miss out on credits your business has already earned. Estimate your potential annual savings using our WOTC Calculator.

Tighten Up Your Financial Close

Now is the time to reconcile accounts, review expenses, and ensure every payment and deduction aligns with your books. A clean year-end close makes filing 1099s, W-2s, and ACA reports far less stressful.

Integrated payroll and accounting systems eliminate double data entry and help flag inconsistencies early. Instead of scrambling in January, you’ll start the new year with reconciled reports and confidence that every number checks out.

Prepare for Key Early-Year Tax and Compliance Deadlines

The first quarter brings a wave of reporting obligations. Mark your calendar for these key dates:

- January 15: Fourth-quarter estimated tax payments due

- January 31: W-2 and 1099 distribution and filing deadline

- Late February or March: ACA 1095-C submission deadlines, depending on filing method

Meeting these deadlines is easier when your systems are connected. Integrated HR and payroll platforms automatically generate the required forms and reports, pulling verified data from across your organization—so you can file accurately and on time without manual data pulls or spreadsheet headaches.

Close with a Forward Look

A smooth year-end sets the tone for a strong start to 2026. Taking time now to review your systems, capture your available credits, and verify your data pays off when the calendar turns.

Your back office should work as hard as you do: streamlined, compliant, and ready for growth. Whether it’s verifying employee records, tightening financials, or leveraging tools like WOTC, a little preparation now means fewer surprises and more momentum in the months ahead.

Simplify your year-end with clarity, not chaos.

Integrated payroll, HR, and tax systems ensure that every part of your operation, including people, processes, and payment, moves in sync. Set your business up for success in 2026 by taking your year-end checkup seriously today.