The Restaurant Year End Crunch

As a GM, you know the end of the year always sneaks up faster than expected. Between managing seasonal turnover, reconciling tips, adjusting schedules, and staying ACA compliant, it can feel like the busiest time of the year never slows down. Add in tax deadlines, W2 filings, and audit prep, and it is no surprise that year end can feel like a marathon.

The good news is that you can make it manageable. With a few proactive steps, your team can simplify closeout, capture hidden savings, and start 2026 with a clean slate and a stronger operational foundation.

If you have not already, take a moment to review our Year End Planning for Growth and Efficiency in 2026 and Quick Audit for Busy Teams posts. Both offer practical checklists and time-saving strategies that complement the steps below and can help you streamline your final weeks of the year.

Get Ahead of Payroll and Tax Reporting

Payroll accuracy at year end is nonnegotiable. Start by confirming employee data such as names, addresses, and Social Security numbers so your W2s are correct the first time. Review delivery preferences to ensure everyone receives their forms on time. Don’t forget to audit ACA reporting and verify that tip credits are being properly applied. These steps may sound routine, but catching errors now prevents delays and compliance headaches later.

If your payroll, timekeeping, and accounting systems connect seamlessly, you’ll spend less time reconciling and more time focusing on what really matters: running your business. Integrated systems also simplify report generation, ensuring your data flows accurately across every platform.

Don’t Overlook Work Opportunity Tax Credits (WOTC), Your Hidden Year End Savings

One easy win before year end is the Work Opportunity Tax Credit, or WOTC. This federal credit rewards restaurants for hiring employees from certain target groups such as veterans or long term unemployed workers.

Take a moment to confirm your recent hires were screened for WOTC eligibility and that certification requests were filed within 28 days of hire. A quick check now could translate into real savings on your location’s bottom line.

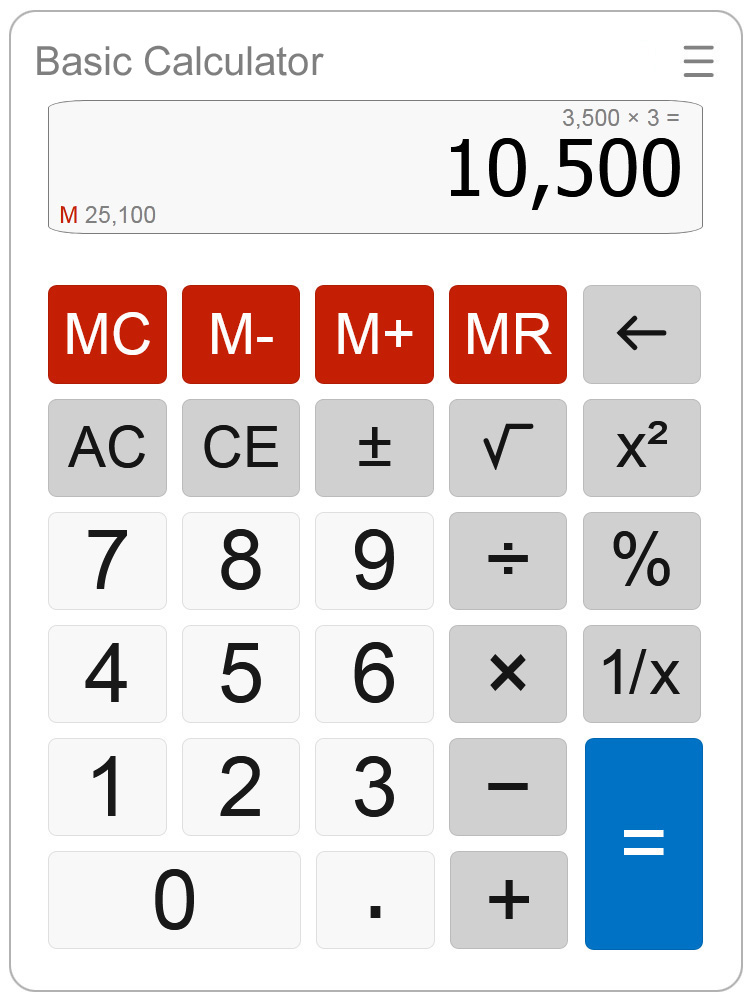

When your HR and payroll systems are integrated, this process becomes almost automatic, helping your team capture every credit available without extra paperwork. Estimate your potential annual savings using our WOTC Calculator.

Mike, a Marco’s Pizza multi-unit operator, grew from one store to five and payroll became his biggest headache. AllianceHCM made implementation seamless, simplified payroll across locations, and uncovered hidden savings through WOTC. Read Mike’s story here.

“With other platforms, I was just another number in a giant system. If I needed help, I’d wait and hope for someone to call me back. With Alliance, I get real people who know my business and actually care about my success.”

Mike – Multi-Unit Operator

Review Your Financial Data for Accuracy

Now is also the perfect time to check your numbers. Review general ledger posting timelines, labor variance by location, and overtime percentages relative to total labor costs. These metrics offer valuable insights into where your operations are running efficiently and where adjustments might be needed. Cross check your payroll and accounting data to ensure everything aligns before final reporting. By tightening your financial close now, you’ll make upcoming audits, forecasts, and planning sessions far smoother and more accurate.

You can also reference our Quick Audit for Busy Teams article for a simple step-by-step framework to run this review efficiently without disrupting operations.

Prepare for Early 2026 Compliance Tasks

When the new year begins, deadlines approach quickly. Preparing now can prevent last-minute stress. Key dates include fourth-quarter tax payments on January 15, W-2 and 1099 filings by January 31, and ACA 1095-C submissions in late February or March, depending on how you file.

Use this window to verify that your payroll and HR systems are ready to produce these reports automatically. With the right integrations, you’ll generate accurate filings without relying on manual data pulls or late night spreadsheet work.

Finish Strong, Start Smart

Your attention to detail now sets the tone for your entire team. By verifying employee data, leveraging WOTC credits, and reviewing your numbers early, you will eliminate year end chaos before it starts.

A smooth closeout means your restaurant begins 2026 focused on what really matters, your guests, your team, and your growth goals, not on catching up with paperwork.

You have guided your location through another successful year. Your attention to detail now sets the tone for your entire team. By verifying employee data, leveraging WOTC credits, and reviewing your numbers early, you will eliminate year end chaos before it starts.

A smooth closeout means your restaurant begins 2026 focused on what really matters, your guests, your team, and your growth goals, not on catching up with paperwork.

You have guided your location through another successful year. Now it is the time to finish the year strong and move confidently into 2026.