Payroll Tax Management

Tax Calculations

Tax Deposits

2026 Tax Reports

How Our Payroll Tax Management Team Can Help You

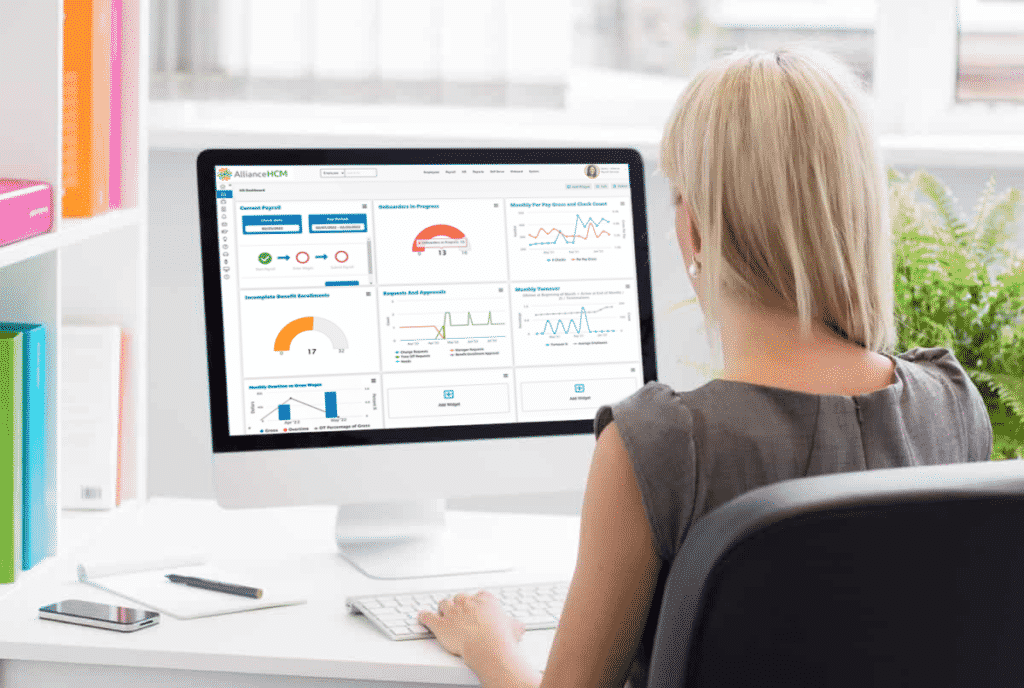

Benefit from a paperless flow of data to and from our payroll processing services.

Rely on a service that calculates and pays both employee and employer payroll taxes.

Rest assured your payroll tax deposits are made accurately and on time, every time.

Easily create the standard annual reporting forms needed to meet IRS requirements.

Export payroll tax liability information to your accounting system in the proper general ledger (GL) format.

Accurately complete gross-to-net calculations and get support with your tax-related notices.

Processing Payroll for More Locations? No Problem.

IRS Form 4070

Payroll Resources for Restaurants

Tax Credits

Tax Credits

Read More About Payroll

Understanding and dealing with the intricacies between payroll taxes vs income taxes can be overwhelming for employers and small businesses. When comparing payroll taxes vs income taxes, they may appear similar. However, each tax serves a distinct purpose within the tax structure.

The future of human capital management (HCM) puts a heavier emphasis on employee satisfaction driving results. As businesses adapt to evolving landscapes, embrace technological advancements, and navigate changing workforce dynamics, CFOs must stay ahead. Post-pandemic disruptions and emerging technologies have left the door open for the future of HCM.

These common payroll errors can be costing your business time and money. Learn how to avoid them with help from AllianceHCM.

Answered On This Page

AllianceHCM payroll tax management helps ensure payroll taxes are calculated and paid correctly, including both employee and employer payroll taxes. The team completes, reconciles, and files quarterly and year-end payroll tax forms so your records stay centralized and compliant.

AllianceHCM makes payroll tax deposits accurately and on time, every time, reducing the risk of missed deadlines and costly errors. It also supports gross-to-net calculations and helps you respond to tax-related notices when issues come up.

Yes. AllianceHCM supports multi-location and multi-EIN organizations, including out-of-state employees, so each location’s withholding and Form W-2 reflect the correct payroll tax jurisdiction. This helps multi-unit operators stay accurate regardless of where employees work or how they’re paid.

AllianceHCM helps you generate the standard annual reporting forms needed to meet IRS requirements and keeps payroll tax reporting organized for year-end. The goal is “spotless” payroll tax records through correct completion, reconciliation, and filing.

Yes. AllianceHCM lets you export payroll tax liability information to your accounting system in the proper general ledger format, helping finance teams keep payroll and tax activity aligned without manual rework.

Schedule a test drive today

Let us show you why our clients rave about our comprehensive HR and payroll solution.