Payroll is an essential part of your business’ operations. Keeping this process organized and accurate is crucial to ensuring your organization is efficient. However, costly payroll mistakes do occur and some might be more common than you may realize.

Read on to learn more about common payroll mistakes and what business owners can do to avoid them.

The importance of accurate payroll

Avoiding payroll mistakes is important for many reasons. First and foremost, payroll mistakes can be costly. There’s the financial cost of these errors that can result in money lost and tax law penalties. In extreme circumstances, legal cases have been known to add considerably to the error.

You must also consider the indirect costs of payroll errors. When and how much you pay an employee is an important part of their lives. Your team relies on accurate paychecks and overtime wages for their livelihood. Additionally, they require payroll to accurately reflect their income tax and more.

Payroll mistakes can be disheartening and frustrating for your workforce. Whether you operate a large corporation or are a small business owner, it’s important to prioritize a seamless payroll process. This helps your company be both profitable and retain talent.

Common payroll errors

Without further ado, here are some of the most common payroll issues businesses run into and how you can avoid them.

1. Misclassified employees

This is one of the most common payroll problems businesses come across. As Indeed explains, employment classifications help ensure companies are compensating workers fairly. It also helps businesses follow federal and state laws regarding fair labor practices.

Some common examples of misclassifying employees are:

- Classifying an employee as an independent contractor when they’re not

- Denying overtime wages to non-exempt salaried staff

The consequences of this payroll error can be millions of dollars depending on the scale.

Be vigilant about worker classification practices. Take time to ensure all your employees are classified correctly. An online system can help HR professionals better organize this information to check it at a glance.

2. Miscalculation of hours worked

It’s important to accurately capture employees’ work hours. Whether they work 40 hours a week, operate part-time, or are eligible for overtime, miscalculating can be time-consuming to resolve.

By some estimates, it takes businesses five to 10 days to fix payroll errors. This is frustrating for everyone involved and can even be the push for employees to search for a new position. Payroll software can help solve part of this issue by keeping employees and managers accountable.

3. Incomplete or inaccurate taxes

Payroll involves a lot more than simply paying your employees accurately and on time. As a business, you’re also responsible for other things that fall under the payroll umbrella, such as:

- Calculating and paying employee and employer taxes

- Depositing tax withholdings from employees’ paychecks to the correct government agency

- Reconciling reports and filing payroll tax returns

There are a lot of little mistakes that can occur as you calculate tax rates that can result in major penalties. A payroll tax management system can alleviate some of the stress of making your tax deposits on due dates and accurately. These systems can automate the process from start to finish.

4. Buddy punching

This is a common payroll error caused by employees clocking in for others during their shift. Some estimate 75% of businesses are affected by this practice and it costs employers an average of 2.2% of their payroll.

While this may seem like an unavoidable problem, upgraded time clocks can help solve it. Consider investing in a biometric time clock to accurately represent the time when an employee punches in and out.

Continue to build trust and loyalty among your employees, as this is the best way to help mitigate this practice from the start.

5. Missing garnishments

Small businesses may not realize they can be held responsible for collecting and paying court-ordered debts owed by their employees. Garnishments can include things like fines, taxes, and child support. Wage garnishments are more common than you may realize and can result in severe consequences if mishandled.

Garnishment services can provide relief through expert guidance. Guidance takes the stress out of compliance with complex legal requirements and allows you to more easily focus on your business.

Steps to fix costly mistakes

How to correct payroll mistakes is often more important than the mistake itself. By following these straightforward steps, you can steer clear of common faults and fix issues swiftly:

- Familiarize Yourself with FLSA Requirements: Stay up-to-date with the Fair Labor Standards Act (FLSA) guidelines. This helps ensure compliance with regulations regarding minimum wage, overtime, and employee classifications.

- Accurate Employee Classification: Properly differentiating between exempt and nonexempt employees is crucial for determining eligibility for overtime pay. This step can help prevent issues related to underpayment or overpayment.

- Maintain Thorough Record-Keeping: Meticulous record-keeping is essential. Keep track of work hours, wage rates, and relevant tax forms to establish a solid foundation for your payroll process.

How to correct payroll errors

Despite best efforts, errors can occasionally slip through. Let’s explore a couple of common blunders and the necessary corrective actions:

Payroll Error Underpayment: Overpaid wages? Mistakes happen, and if an employee is inadvertently underpaid, follow these steps for resolution:

- Promptly address the issue by calculating the missing amount and provide the corrected payment as soon as possible.

- Transparent communication is key—apologize for the error and assure the employee that it will be promptly rectified.

Example: Consider Sarah, an exempt employee, who receives an underpayment due to an oversight in her overtime hours. Upon discovering the error, Sarah’s employer swiftly recalculates her wages and ensures she receives the missing amount on her next paycheck.

They express their apologies for the mistake while emphasizing their commitment to accurate payroll.

Payroll Error Overpayment: Accidentally overpaid an employee? Here’s how to overcome the error:

- Notify the employee of the error and collaborate to establish a repayment plan that is fair for both parties.

- Consult relevant laws and employment agreements to ensure a satisfactory resolution.

Example: Imagine John, a non-exempt employee, receives an overpayment due to a clerical error in his hourly rate. Once the employer realizes the mistake, they engage in an open conversation with John. Together, they agree on a repayment plan that minimizes financial impact on John while addressing the overpayment.

How to fix payroll mistakes and avoid payroll errors

Prevention is always preferable to correction. By incorporating these steps to avoid mistakes, you can reduce the likelihood of payroll errors:

Thoroughly Review Before Processing: Take a moment to carefully review all details before running payroll. Verify hours, rates, deductions, and tax forms to identify and rectify any discrepancies.

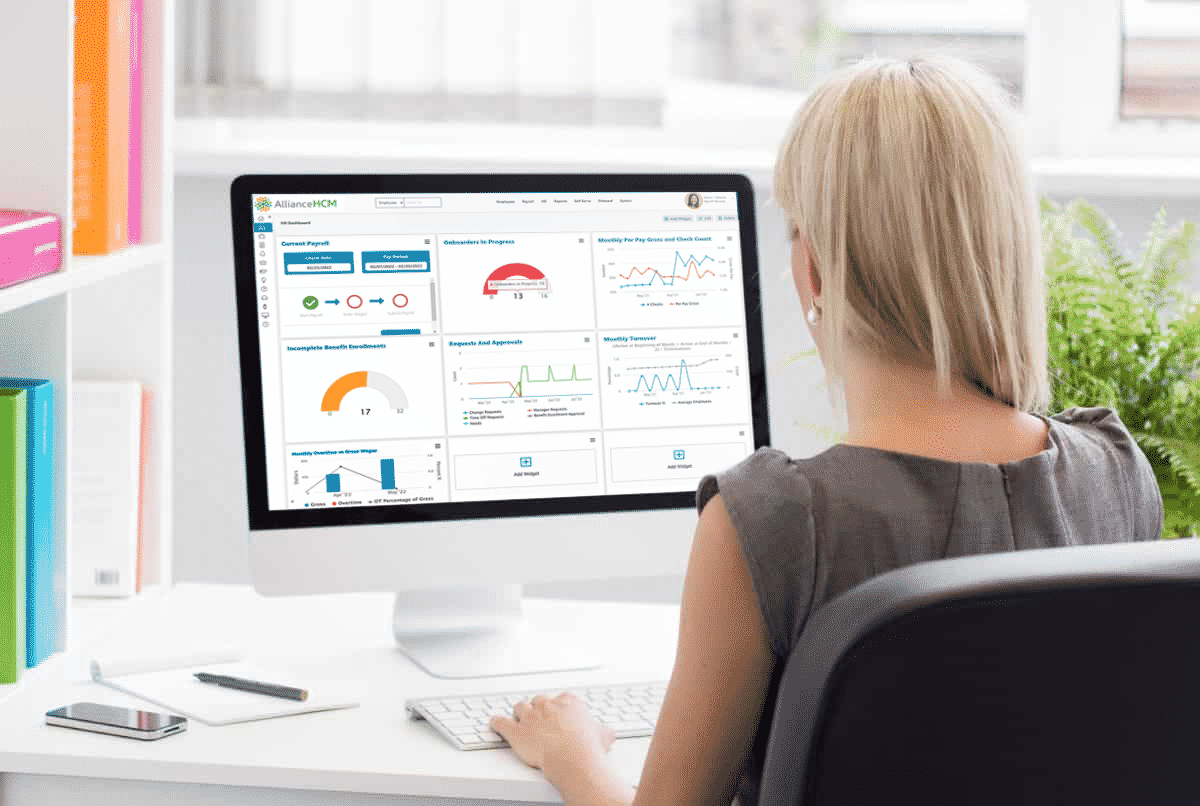

Automate Payroll Processes: Consider utilizing payroll software or tools to automate calculations and minimize the risk of manual errors. These tools can help you stay compliant with FLSA requirements, accurately classify employees, and manage tax-related matters.

Seek Professional Guidance: Don’t hesitate to consult experts such as accountants or payroll specialists. Their insights can prove invaluable in ensuring compliance with regulations and best practices, reducing the likelihood of costly mistakes.

Ready to improve your payroll processes for the better and avoid these common payroll mistakes? AllianceHCM Payroll and Tax Solutions can help your business run more efficiently. Schedule a demo today.